반도체 선도 제조업체들은 최근의 지정학적 긴장과 미국/중국 경제의 급속한 관계변화 등으로 인해, 반도체 Fab의 글로벌 운영을 다각화 하기 위한 새로운 입지 선정에 고민이 깊어지고 있다. 이에 커니는 반도체 Fab 입지선정에 영향을 주는 사업환경, 인센티브 및 운영비용을 정량화 하여, 입지 선정에 있어 전략적 고려사항에 Insight를 제공하고자 한다.

결론적으로 반도체 제조 중심지 중 1. 한국과 대만은 여전히 안정적인 사업환경과 인프라를 갖추고 있으며, 2. 아시아 High-end 대안으로서 일본과 싱가포르가 유력한 후보지로 부상하고 있다. 새롭게 Fab 건설을 고려해 볼만한 신흥국은 인도와 베트남이 매력적일 수 있으나, 인프라와 엔지니어 인력의 수준, 정부의 유치를 위한 투자 등 세부적인 검토가 필요하다.

The semiconductor is a cornerstone of modern life, and its industry is experiencing a significant shift. Specifically, the geography of semiconductor production, long concentrated in a few hubs, is entering a new era of fragmentation and dispersal, driven by a combination of global factors that are unlikely to abate anytime soon.

Press play to listen to this article.

Given the substantial capital investments involved, semiconductor companies must ensure that fabrication facilities (often referred to simply as fabs) are well researched and meticulously evaluated before they commit significant resources and capital to these extremely expensive long-term projects.

Historically, semiconductor manufacturing and supply chain activities have remained predominantly anchored within a small group of geographies. To understand the dynamics of this market concentration, it’s important to consider the two primary stages of semiconductor production.

These two stages are known as the “front end” and the “back end,” and while both are of course technologically complex and demanding, they are not equally so—and the gap between them explains much about the current geography of production.

The “front end” of semiconductor manufacturing involves the fabrication of the wafer itself. This stage is considerably more automated and capital intensive than the “back end” of production, which consists of the assembly of the integrated circuit, testing, and final packaging. At the back end, the cost of labor is an important consideration; for the more technologically complex front end, labor costs matter but represent a smaller share of total operating expenditure.

While back-end production takes place in several countries around the world, the actual building of wafers at significant scale has remained limited to only a handful of geographies.

This high level of concentration in front-end production reflects the cost and complexity of wafer development. The few countries that have established themselves as credible players in this market have developed extensive production infrastructures and significant economies of scale, ensuring access to materials, capital, and human talent.

Furthermore, their governments provide—in varying ways and to varying degrees—the basic supports required for the sustenance of this unique industry, including direct financial co-investment, indirect subsidies and incentives, and mechanisms for the protection of sensitive intellectual property.

As global demand for semiconductors continues to boom, the firms that make them (commercial foundries, integrated device manufacturers, or IDMs, often referred to simply as “semiconductor companies” in this report) have already embarked on bold and ambitious initiatives to expand their production networks—and much of this expansion remains concentrated among geographies with established front-end capabilities. Samsung has invested $10 billion in a cutting-edge facility in Austin, Texas, while TSMC has allocated $40 billion for two advanced fabs in Arizona. More recently still, South Korea announced plans to build the largest semiconductor hub in the world near Seoul, pledging approximately $470 billion in a public–private partnership with Samsung and SK Hynix.

However, geopolitical tensions and the rapidly evolving relationship between American and Chinese economies have catalyzed a comprehensive reevaluation of the semiconductor industry’s operational strategies.

In response to these transformative forces, global semiconductor companies are rethinking their current footprints, and increasingly emphasizing the importance of global operational diversification. They are increasingly open to considering new markets for front-end production. Given the enormous levels of investment involved, this is a decision with major ramifications for producers—and for national governments.

To aid decision-makers in these assessments, Kearney has conducted an extensive analysis of the factors influencing the selection of fab locations. From our comprehensive analysis of certain highly salient and relatively quantifiable factors—notably business environment, incentives, and operating costs—several useful findings have emerged, providing insights into the strategic considerations that guide semiconductor companies in choosing locations for fab construction.

1. Factors driving the Manufacturing Attractiveness Index

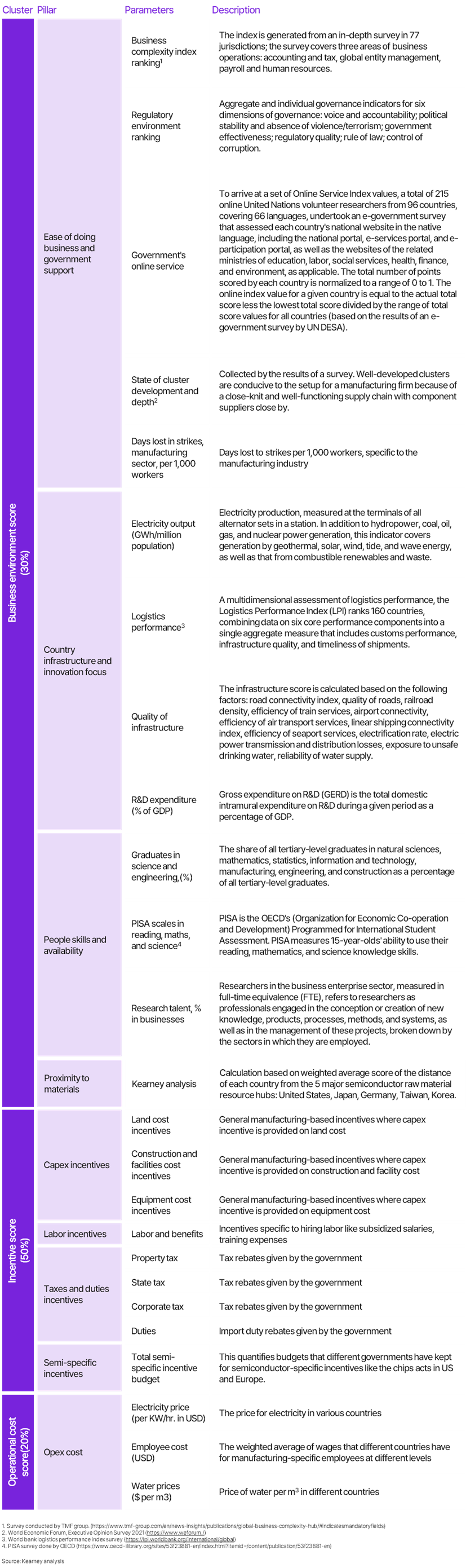

Through this analysis, Kearney has produced a metric called the Front-End Semiconductor Manufacturing Attractiveness Index, which evaluates the leading quantifiable factors guiding semiconductor production investment decisions. The Index focuses on three major factors, which we introduce below.

Business environment

A favorable business environment is essential for the smooth operation—and protection—of a semiconductor company's assets and innovations.

This encompasses a geography's legal and regulatory framework, intellectual property protection measures, overall outlook toward innovation, and the availability of skilled talent. These factors loom large and cannot always be taken for granted even in established production markets. To cite just one example, TSMC was supposed to open its new Arizona fab by 2024, but had to delay the opening by a year, due primarily to a lack of workers with the required expertise.

Incentives

Incentives have become a crucial consideration for semiconductor companies evaluating new destinations, as more and more countries join the race to establish semiconductor manufacturing capabilities. India, mainland China, the United States, several European geographies, and other major global players actively offer incentives and support to attract semiconductor companies and encourage the development of fabs within their borders.

Now, other countries are following suit, offering a range of incentives. These can include upfront cost reduction opportunities through land and utilities deals, tax breaks, financial subsidies, and other incentives offered by national, subnational, and local authorities. These may come in the form of general manufacturing incentives, or as targeted incentives rolled out specifically to attract semiconductor companies.

Such inducements can significantly drive down the high capital expenditure (capex) requirements of establishing a new fab. Tax abatements and other forms of public subsidy need to be offered judiciously, since an overly compromised revenue base can impede the provision of vital public services, such as education and infrastructure, upon which semiconductor companies will depend for their long-term operations. However, over the longer run, the financial benefits of a fab far outweigh the likely loss in tax revenues, due to the infusion of high-income jobs that ultimately contribute to increased income tax revenues and overall economic gains.

Operating costs

Operating costs comprise various elements, including labor expenditures, utilities expenses, and the overall cost of running a complex supply chain. Understanding and managing these costs is vital for the long-term viability and profitability of fab operations.

These three factors are summarized in figure 1.

► Figure 1: The Index analyzes parameters across three broad segments

Each of these factors plays a distinct and influential role in the decision-making process when selecting fab locations. By carefully evaluating and balancing these factors, semiconductor companies can make informed choices that align with their strategic goals and objectives, ultimately contributing to their long-term success in a continuously evolving industry landscape.

2. Analysis of leading front-end semiconductor production centers

Our study looked at two broad categories of national markets for front-end semiconductor production: the established manufacturing hubs that have long dominated the sector, and the emergent ones that we think may be best positioned to capitalize on the trend toward more diversified global manufacturing footprints. We look at each of these categories in the sections below.

Established front-end semiconductor manufacturing hubs

The first category consists of geographies that already have an established front-end semiconductor manufacturing capability. This base of experience reduces risks for producers—a serious selling point when it comes to investments as large as a semiconductor fab.

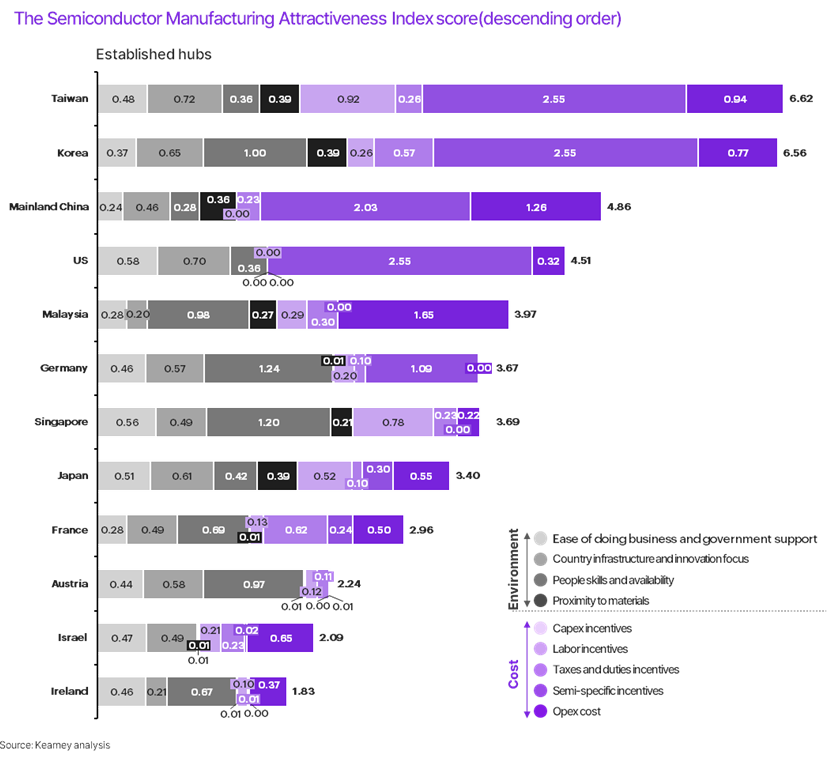

The two frontrunners: Taiwan and South Korea

These two East Asian geographies emerge as leaders across all evaluated factors, offering a stable business environment, high-quality infrastructure, a well-developed ecosystem, and judiciously targeted subsidies.

Such considerations help explain why Taiwan and South Korea have already established themselves as leading global chip-producing geographies, together accounting for more than 63 percent of the global foundry market (includes all types of foundries, such as IDMs, turnkey, and so on). Functionally, this represents 150mm, 200mm, and 300mm wafers. However, it is worth noting that the Taiwanese and South Korean semiconductor production markets are almost exclusively domestic, attracting virtually no foreign companies. By contrast, some of the larger economies listed below—such as the United States and Japan—are global hubs that attract considerable investment from foreign firms.

“High-end” Asian alternatives: Japan and Singapore

Established semiconductor hubs such as Japan and Singapore excel in terms of the business environment and offer well-designed subsidy programs. However, neither of them can offer the cost advantages of Taiwan or South Korea.

Established North Atlantic leaders: the United States, Germany, and France

The United States and certain leading European geographies offer generally strong business environments and sound technology infrastructure. In addition, the US and Europe each allocate substantial amounts for semiconductor-related initiatives. However, placing a fab in these geographies also entails some of the highest operating costs in the world—almost 40 percent more than those of their Asian counterparts.

The low-cost overachiever: Malaysia

Speaking of costs, here’s an established player with a serious track record—and the lowest costs to be found in this market category. Already a prominent player in the back-end market, with about 13 percent of global share in that vital sector, Malaysia qualifies as a significant semiconductor hub, and its stature is growing. In August 2023, Infineon announced a $7 billion investment in a front-end facility dedicated to the fabrication of silicon carbide (SiC) chips.

Malaysia offers a five-year income tax holiday to electronics companies establishing manufacturing operations within its borders. The exemption of import duties on raw materials and components further enhances Malaysia’s appeal as the least costly market among established semiconductor manufacturing geographies.

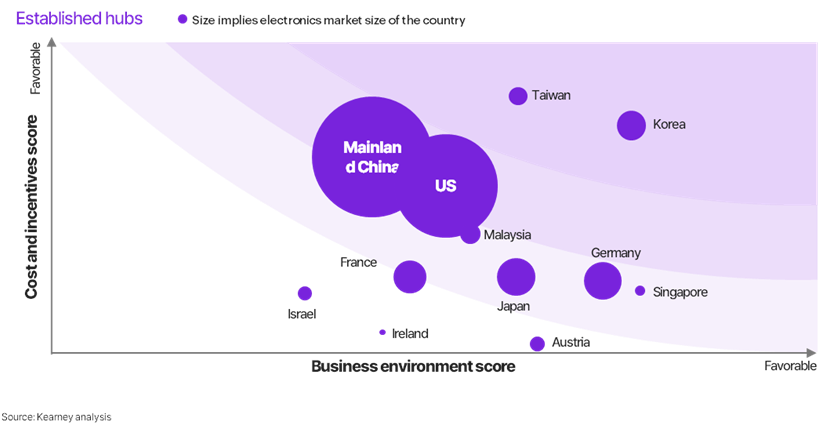

Figures 2 and 3 offer visual illustrations of the primary metrics we used in assessing the geographies in this category.

► Figure 2: There are 12 countries with major fabs in the Semiconductor Manufacturing Attractiveness Index

► Figure 3: Taiwan and Korea are the frontrunners in the Index

Emergent semiconductor manufacturing hubs

The second group of countries that semiconductor manufacturers can explore are emergent destinations that are poised as promising options for manufacturing. These countries compensate for their lack of front-end fabrication experience and comparatively less robust business environments by offering generous subsidies and relatively low operational costs.

India

The appeal of the world’s most populous geography as a semiconductor production market rests on the availability of skilled labor and relatively low operating costs. But India has also made some assertive moves on incentives as well. In order to foster the development of a vibrant domestic semiconductor manufacturing industry, the Indian government has earmarked a substantial chip fund amounting to $10 billion. This initiative encompasses diverse production-linked incentive schemes, as well as incentives such as rebates on capital expenditure and equipment.

Such measures are beginning to show signs of promise. Notably, discussions between Israel's Tower Semiconductor and the Indian government regarding the establishment of a front-end fab took place in late 2022. In late 2023, GlobalFoundries was looking for local partners to set up a fab in India and even held talks with a few local companies. However, these talks have not yet resulted in any firm commitments.

While India has immense potential in this sector, it also has some challenges to overcome, such as the lack of an established front-end semiconductor ecosystem, the presence of only a limited back-end sector, and unreliable access to electricity and water in some areas.

Vietnam

This Southeast Asian country has unmistakable ambitions in the chip sector, having unveiled plans to train 50,000 semiconductor specialist engineers between 2023 and 2030.

This planned surge in skilled personnel would complement Vietnam’s status as one of the most affordable labor and utility markets in the region.

In addition, Vietnam offers sizable income tax breaks, including a 100 percent exemption for up to four years, followed by 50 percent for the subsequent nine years, along with up to three years of land lease exemptions.

Despite these efforts to position Vietnam as a strong contender for front-end manufacturing, companies may still balk due to an ongoing power supply crisis. An even larger consideration is the absence of a dedicated and detailed investment plan for the semiconductor industry. Here, Vietnam might be well-advised to take some cues from one of its regional neighbors.

As noted in the last section, Malaysia has laid the groundwork for front-end semiconductor production by first establishing a strong position in back-end operations, creating all of the supports needed for that segment of the industry, before stepping up to the greater demands of front-end manufacturing. Vietnam could—and should—follow a playbook similar to the one that Malaysia has already used so effectively.

Italy

Among European geographies, Italy has allocated $4.4 billion for investments in the semiconductor industry. In late 2022, ST Micro committed to spending €730 million over five years to establish a silicon carbide plant in Catania. Italy is already home to ST Micro’s power electronics fabs, located in Catania and Agrate.

The presence of these facilities and their support network makes Italy an attractive option for semiconductor manufacturers looking to establish future fabs. The recent investments in the Italian semiconductor industry reflect the geography’s commitment to enhancing its strategic role as a European hub for the design, manufacturing, and assembly of semiconductors. However, despite these ongoing efforts, Italy still lags behind its European and global competitors.

Mexico

Mexico’s long border with the world’s largest national economy solidifies its position as a strategic potential option for locating a fab.

The US and Mexico have launched a joint "semiconductor action plan" that aims to make North America the world's most powerful semiconductor production region. Mexico is already in talks with the US on how to collaborate on manufacturing, starting with chips for electric vehicles. In addition, Mexico offers income tax rates of 20 percent instead of the usual 30 percent for companies in the border zone, as well as duty-free imports for 18 months.

However, companies continue to cite Mexico’s political instability and high crime rate as a concern, especially because establishing a fab would require importing a significant share of workers from outside the country to meet demand in the short term.

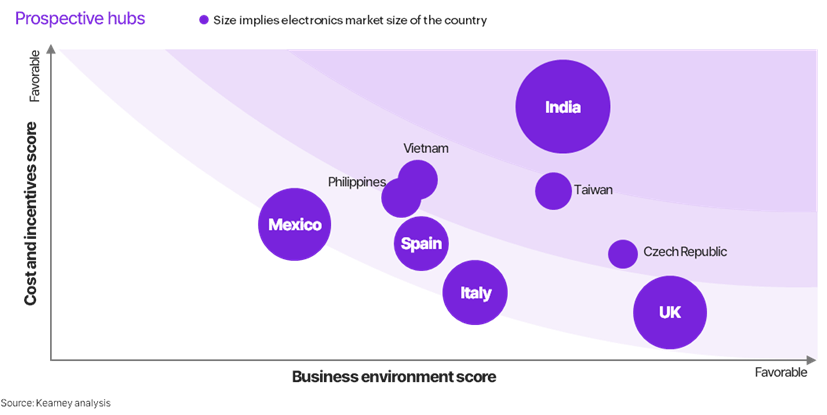

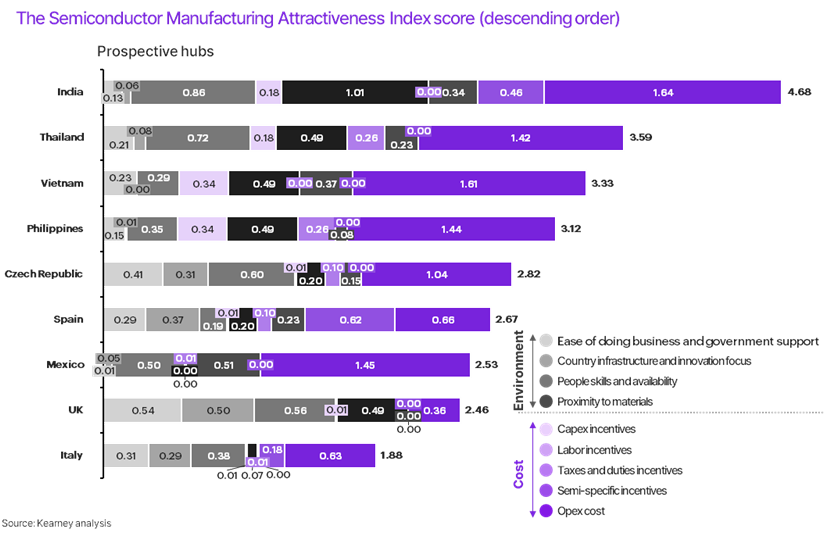

Figures 4 and 5 illustrate our quantitative findings.

► Figure 4: Nine countries are emerging and poised to position themselves as promising options

► Figure 5: India leads the way among emerging countries

3. Conclusion

The ongoing surge in demand for digital components of all kinds will mean a continued expansion of the semiconductor manufacturing sector. The decision of where to place new production facilities is becoming ever more important—and ever more complicated. This is especially so for front-end facilities, with their more stringent technological requirements and higher costs.

So far, these factors have led companies to restrict their front-end fab construction to a very small handful of geographies, but this dynamic is under pressure, both from surging chip demand and the need to diversify sources of production in the face of growing geopolitical uncertainty.

Kearney offers the Manufacturing Attractiveness Index as a guide for companies seeking to navigate this decision. We hope it provides a useful tool for aiding the process of site selection and eventual production. This is a highly dynamic and rapidly changing sector, and we plan to continue to closely track these and related metrics for both front-end and back-end semiconductor production in the years to come, developing an ever evolving mechanism for these crucial and highly complex investment decisions.

The authors would like to thank Arun Singh, Guido Hertel, and Bharat Kapoor for their valuable contributions to this article.